I Need Advice: My Husband* Is So Cheap

*Anything said here can apply to people of any gender and to any type of relationship

"I can't believe you spent $60 on a haircut when you could've done it yourself at home!"

These words might sound familiar if you're married to someone extremely frugal. It's a frustrating situation that can leave you feeling guilty about basic self-care expenses and create tension in your marriage. You might find yourself thinking, "Why is my husband so cheap?!".

As The Couples Financial Coach, I've worked with many couples facing this exact challenge, and I want you to know there's hope for finding a middle ground in how you manage and spend your money together. Let's dive in!

What Does It Mean to Have a Cheap Husband?

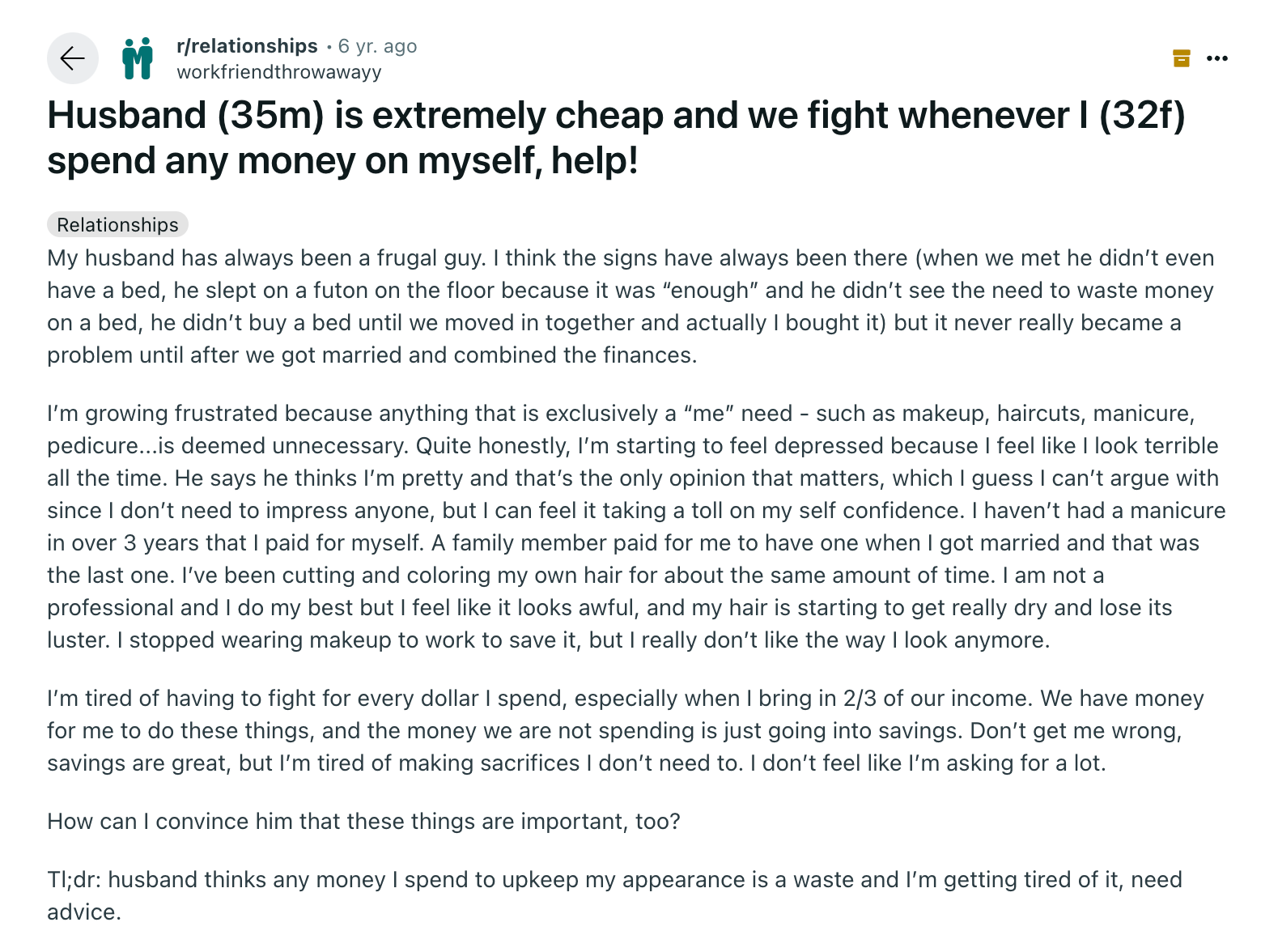

Let's look at a real example from Reddit.

A wife who brings in 2/3 of the household income shares her struggle with a husband who questions every personal care expense she makes. She hasn't had a professional manicure in 3 years and has resorted to cutting her own hair, which is losing its luster.

Despite having adequate savings, her husband sees any spending on personal care as wasteful, leading to constant arguments about money.

This situation perfectly illustrates what it feels like to have a cheap husband. It goes beyond what most people would describe as "being frugal" or "careful with money." You might feel like even reasonable or necessary expenses are now sources of conflict.

Here are a few more examples:

Questioning every purchase you make, even necessities

Insisting on buying the lowest-cost option, regardless of quality

Making you feel guilty about basic self-care expenses

Obsessing over saving money to an extreme degree

Refusing to replace worn-out items until they're completely unusable

Pulling teeth and creating tension whenever you want to spend money on yourself

If you have a husband who seemingly hates spending money on anything, it can feel very frustrating. Especially if they constantly remind you that they're the one "paying for everything."

Why Is My Husband So Cheap?

Understanding the root cause of extreme frugality is very important. Often, what appears as "cheapness" is actually masking deeper financial anxieties or concerns.

Your husband might be experiencing:

Financial Anxiety: Many people carry deep-seated fears about money from their childhood or past experiences. Maybe he grew up in a household where money was always tight or experienced financial hardship that left a lasting impression, no matter how much money is now in your bank account.

Misunderstanding of Priorities: People sometimes struggle to get on the same page about expenses they don't personally value. Your husband might genuinely not grasp why certain expenses matter to you because they're not something they care about.

Communication Gap: Often, couples haven't had deep conversations about their financial values and goals. Without this foundation, it's easy for misunderstandings and resentment to build. Try these 40 financial questions to ask your partner.

Fear of Future Security: Many "cheap" spouses are actually worried about having enough money for the future. This financial stress can manifest as extreme frugality in the present, even when it's not necessary.

Ultimately, most people aren't being cheap just to make their spouse miserable.

Understanding that their behavior often comes from a place of concern rather than control can help you approach the situation with empathy while still working toward positive changes in how you handle money together.

How Do I Deal with a Stingy Husband? 9 Steps to Take

1. Understand Their Money Story

Everyone has a unique relationship with money shaped by their past experiences, upbringing, and personal values. Your husband's extreme frugality might stem from deeply ingrained beliefs or experiences that he may not even fully recognize.

For example, if he'd experienced a significant financial setback in the past, he might have developed an intense need for financial security.

I can personally attest to this. Even though I'm now The Couples Financial Coach, I have experienced setbacks in my own money story, and these setbacks still sometimes trigger an emotional reaction.

For example, I often worry about annoying things like a bottle of water costing $3 at a gas station and not $1.5. I have to catch myself and let these emotions go.

Understanding your own money story is equally important.

You might have strong emotional reactions to certain financial situations – feeling resentful when questioned about small purchases or anxious about saving for the future.

Recognizing these patterns in both yourself and your spouse can help foster a more open dialogue about money.

2. Create Shared Financial Goals

Shifting the conversation from daily spending debates to broader financial aspirations can transform how you both approach money. Sit down together and discuss what you want your future to look like.

Whether it's buying a home, planning for retirement, traveling the world, or funding your children's education, having shared goals creates a framework for making spending decisions that align with your mutual vision.

Break these larger goals into smaller, manageable milestones that you can track together. This approach helps both partners see how daily spending choices impact your long-term objectives and can make it easier to find a compromise on current expenses.

3. Implement a "Fun Money" System

One of the most effective ways to reduce financial tension is to establish personal discretionary funds for each partner.

This means setting aside a fixed amount each month that each person can spend without question or judgment. It can be just $20 or $50 - whatever makes sense for your income!

Having this freedom can significantly reduce conflicts over personal spending, but you'll still maintain overall budget control.

When your husband is reluctant to spend money, it can be difficult to choose an amount that feels fair to both partners. Try starting with a smaller amount and adjusting as you go.

It might take some work to get your spouse to commit to this system without questioning or criticizing, but my Pathways to Prosperity program can help!

4. Use Data-Driven Discussions

Emotions often run high when it comes to money, so it's important to track your expenses and review them together objectively. In my experience, this is especially important when one partner manages most of the household spending while the other is the primary earner.

Seeing detailed breakdowns of expenses can help the earning partner understand why certain costs are necessary and prevent the spending partner from feeling constantly scrutinized.

For example, tracking how much you spend on cheap, frequently replaced items versus higher-quality, longer-lasting alternatives can show your spouse the true cost of extreme frugality.

Just make sure to make these conversations about facts, not feelings.

5. Take Value into Account

Have conversations with your spouse to encourage them to move beyond looking at price tags and consider the deeper value of purchases. Discuss what matters most to each of you and allocate your resources accordingly.

This might mean spending less money in areas that matter less to both of you so you can spend all the money on things that significantly impact your quality of life.

You can both try rating different categories of spending based on their importance to you. For example, maybe you realize that you both care little about dining out but want to allocate more money for quality kitchen gadgets to eat better at home.

6. Agree to Disagree

Popular culture bombards us with the idea that only couples who agree on everything can be happy, but in reality, you don't need to share identical views on spending to have a healthy marriage. Many happy couples maintain different perspectives on money while finding workable compromises.

Try acknowledging that your partner's approach to money, while different from yours, isn't wrong – it's just different.

Then, focus on finding a middle ground that respects both your need for security and your desire for a more comfortable lifestyle.

You DON'T need to have the same financial views to be compatible, but you DO need to be able to discuss differences respectfully and work toward solutions that consider both partners' needs and concerns.

7. Address Financial Anxiety

If your husband's extreme frugality comes from deeper anxieties about financial security, they might benefit from professional help. A therapist or a financial coach can help them address these fears and develop a healthier approach to managing and spending money.

(Yes, your partner may at first say that a therapist or a financial coach is a waste of money. In this case, showing them real stories of people who were able to overcome financial challenges with additional help can be helpful.)

8. Set a Budget

If your husband scrutinizes every purchase, it can be helpful to establish clear spending thresholds.

Agree on an amount below which either partner can spend freely without consultation. For example, you may want to discuss big purchases over $100, but anything below that threshold is okay.

This creates clear boundaries and reduces friction around daily purchases. You can update these thresholds periodically as your financial situation changes and to make sure that you're both comfortable with what you spend.

Learn more about budgeting for couples.

9. Regular Money Dates

Schedule monthly financial check-ins in a relaxed setting. Make these positive experiences where you can both openly discuss your financial situation and address any concerns. Keep these conversations forward-looking and solution-focused and don't dwell on past disagreements.

Is a Stingy Guy a Red Flag?

Sharing a life with someone who hates doing things because they cost money can be very frustrating. But while extreme frugality can create relationship challenges, it's not necessarily a deal-breaker.

Different money personalities can absolutely work well together when couples commit to open communication and finding a middle ground.

If you're both willing to understand each other's perspectives and respect each other's needs and values, you can successfully navigate your financial differences and build a stronger relationship.

If you need help getting started, schedule a free consultation with me!

FAQs

What Causes a Man to Be Stingy?

If you're wondering why your husband is so cheap, it may stem from his past experiences with money. This could include growing up in a household where there was never enough money, experiencing financial hardship as an adult, seeing family members struggle with debt, or any other traumatic financial situations.

Sometimes, this behavior comes from anxiety about financial security or a need to feel in control. It might also reflect different values around spending and saving that your partner learned when they were a child. It's important to understand these root causes because what appears as stinginess is often a protective mechanism from past experiences.

What to Do When Your Husband Hides Money From You?

Financial infidelity, including hiding money, is a serious breach of trust that needs to be addressed directly. That said, there are some exceptions, such as hiding money for surprise gifts. Before you do anything, get as much evidence as possible about the hidden funds to make sure you're not making assumptions.

Then, approach your spouse in a non-confrontational way to understand their motivations – are they feeling financially insecure, trying to maintain some independence, or dealing with some kind of issues? Think about working with a financial coach who can help facilitate these difficult conversations and rebuild trust.

Should a Man Pay All the Bills in a Marriage?

There's no universal "should" when it comes to who pays the bills in a marriage. Traditional marriages in the past often had the husband managing all finances, but modern marriages work with all kinds of financial setups. What matters is finding an arrangement that both partners agree on, and that reflects your unique situation, values, and capabilities.

Some couples split expenses 50/50, others contribute a certain percentage based on income, and some have one partner manage all finances while the other contributes in non-financial ways. There's no right or wrong, and a man doesn't HAVE to pay all the bills in a marriage unless that's what works for the both of you.

What Percentage of Marriages End in Divorce Because of Money?

Money is a key issue in many marriages, but it's hard to track this kind of data precisely. Some studies suggest that financial problems contribute to 20-40% of all divorces, and research indicates that 54% of people consider a partner's debt a valid reason for divorce. At the same time, wealthier couples tend to have lower divorce rates and staying married is correlated with higher wealth accumulation.

Ultimately, it's not about how much money you make, but about how you communicate about and manage your finances together. Couples who regularly discuss money and align their financial goals are going to be more satisfied in their marriages.

Can a Husband Cut His Wife Off Financially?

Financial abuse is a serious form of domestic violence. In a marriage, both partners should have a right to shared financial resources, regardless of who earns the money. If your spouse is attempting to restrict your access to money, make sure to get help as soon as possible. Controlling access to family finances as a form of punishment or control is never acceptable in a healthy marriage.

Should Married Couples Keep Their Money Separate?

The decision to combine or separate finances is highly personal and should reflect your relationship dynamics and financial goals. For some couples, joint accounts work great. For others, it's important to maintain some financial independence with separate accounts.

Many successful marriages use a hybrid approach, such as combining money for shared expenses and using separate accounts for personal spending. All kinds of arrangements can work. Just make sure to have open communication and make sure that both partners feel secure and respected.

Get on the Same Financial Page with Your Spouse or Partner

Building a healthy financial relationship when your spouse seemingly hates spending money is hard but not impossible. It doesn't have to doom your marriage!

If you need help figuring out how to get on the right track, schedule a free consultation with me!

Want to level up your game around money in your relationship? My free quiz will help you learn your Couple’s Money Personality Type AND how you can grow from there!

Adam Kol is The Couples Financial Coach. He helps couples go from financial overwhelm or fighting to clarity, teamwork, and peace of mind.

Adam is a Certified Financial Therapist™, Certified Mediator, and Tax Attorney with a Duke Law degree and a Master's in Tax Law from NYU. He is a husband, dad, and musician, as well.

Adam's wisdom has been shared with The Wall Street Journal, the Baltimore Ravens, CNBC, NewsNation, and more.